[ad_1]

Meta Platforms META stock has now soared over +60% this year, hitting all-time highs of $576 a share on Wednesday. Surely investors are wondering if another leg higher is in store for the social media pioneer’s stock.

To address the plausibility of such, let’s see what’s been moving Meta’s stock higher and gauge if there is indeed more upside in META from current levels.

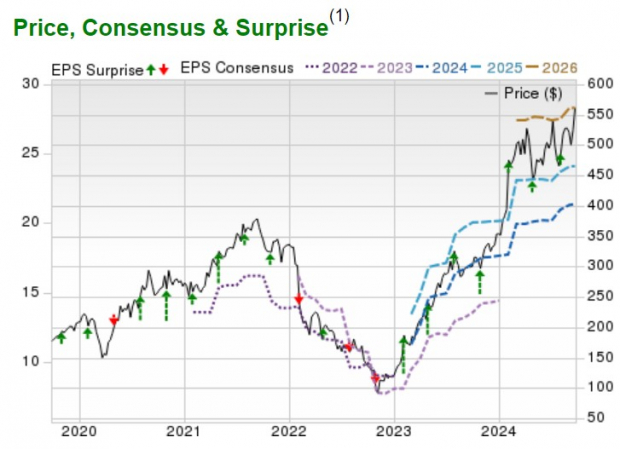

Image Source: Zacks Investment Research

META Stock: Strong Financial Performance

As illustrated in the EPS surprise chart above, Meta has surpassed the Zacks EPS Consensus for seven consecutive quarters posting an average earnings surprise of 12.61% in its last four quarterly reports.

Pointing to the company’s increased probability, Meta most recently reported Q2 EPS of $5.16 in July which beat estimates by 10% and soared 60% from $3.23 per share in the comparative quarter.

Image Source: Zacks Investment Research

META Earns Positive Analyst Ratings

Stemming from Meta’s strong financial performance and further boosting its stock is that analysts have remained bullish on the tech giant’s outlook. Notably, of the 45 brokers covering Meta’s stock and providing data to Zacks Investment Research, 39 have a strong buy rating.

Meta currently has an average brokerage recommendation (ABR) of 1.33 on a scale of 1 to 5 (Strong Buy to Strong Sell).

Image Source: Zacks Investment Research

META’s Innovation and Product Expansion

In regards to the positive sentiment, analysts have remained optimistic about Meta’s opportunities in artificial intelligence. Hosting its annual conference today, Meta CEO Mark Zuckerberg stated Meta AI is one of the most used AI assistants in the world with nearly 500 million monthly users.

The “Meta Connect 2024” event was highlighted by new Meta AI updates including natural voice interactions outside of text. The AI voice interactions are now accessible on all of the company’s main apps (Instagram, WhatsApp, Messenger, Facebook) and will compete against Alphabet’s GOOGL Google Gemini Live and OpenAI’s Advanced Voice Mode.

Meta will also be expanding its business AI solutions to help businesses better serve their customers, offer support, and facilitate commerce. In addition to this, Meta unveiled updated versions of its virtual reality headset (Quest 3S VR ) and gave a glimpse of its Orion augmented reality glasses which it touts as the most advanced AR glasses ever made, combining the look and feel of regular glasses with immersive AR capabilities.

Monitoring META’s Stock Valuation

One reason for the explosion in Meta shares has been the company’s attractive valuation relative to many of its big tech peers. META currently trades at 26.3X forward earnings which is not a stretched premium to the S&P 500’s 24.2X.

Furthermore, META still trades at a sharp discount to its decade-long high of 74.5X forward earnings but slightly above the median of 25X during this period.

Image Source: Zacks Investment Research

Bottom Line

After such a stellar year to date rally, Meta Platforms stock lands a Zacks Rank #3 (Hold). Although there could be better buying opportunities ahead it would be no surprise if META continued to rise with it noteworthy that the Average Zacks Price Target of $579.19 a share still suggests 3% upside.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Source link

Leave a Reply